Property tax is based on the taxable value of property. Most often this is a property’s Factored Base Year Value (FBYV), but when the market value of a property on the January 1 lien date falls below the FBYV, the assessor is obligated to review the property and enroll the lesser of FBYV or market value under Prop 8.

Prop 13 and Factored Base Year Value

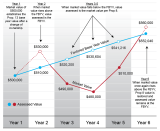

The factored base year value (FBYV) of real property is the market value as of 1975 or as established when the property last changed ownership or was modified due to construction. This amount is then increased by no more than 2% each year (ie: factored) to determine the FBYV. FBYV is shown by the blue line above.

Proposition 8 Temporary Declines in Taxable Value

Proposition 8 requires the county assessor to annually enroll either a property’s factored base year value (FBYV) or its current market value, whichever is less. When the current market value replaces the higher FBYV on the assessor’s roll, this lower value is commonly referred to as a “Prop 8” value. Prop 8 value is shown by the red line above.

When the Market Recovers

Although the annual increase for factored base year value (FBYV) value is limited to no more than two percent, the same restriction does not apply to values adjusted under Prop 8. The market value of a Prop 8 property is reviewed annually as of January 1; the current market value must be enrolled as long as the Prop 8 value is less than the FBYV. A substantial increase in market value can lead to a substantial increase in the Prop 8 value, possibly exceeding 2% growth up to the FBYV. When the current market value of a Prop 8 property exceeds its FBYV, the county assessor reinstates the FBYV, and subsequent increases are again limited to two percent or less.